Zero-Click Checkout

See how technology has advanced shopping checkout on mobile devices.

With a mass transition to mobile for online shopping, media consumption, and so much of our daily lives being integrated with our phones, consumers are in turn buying more on mobile devices. In fact, in December 2017, conversion rates for smartphone users were up 12% compared to 2016. There is a paradigm shift ahead of us for mobile shopping and overall checkout experience as technology adapts to ‘zero-click’ checkouts on mobile, making it faster and easier to buy than ever before.

In the early days of mobile, checking out on a mobile device was harder than on a computer because you had to pinch in to view the website, enter your credit card info one finger tap at a time, and multi-step checkouts required several page loads. This poor consumer experience would result in more people buying on a computer - even if they had initially visited the site from their phone. We’ve seen with our own clients in the past that entering in shipping, billing, and credit card info on a mobile device proved to be a major barrier to mobile conversion.

Now, technology has adapted to allow consumers to ‘zero-click’ checkout on mobile devices, bypassing the need to manually enter billing, shipping, and payment info. Over the last two years we’ve been integrating mobile payment options into our clients’ checkout experience as the technology has become available. Now, on average we are seeing about half of online purchasers using these payment methods.

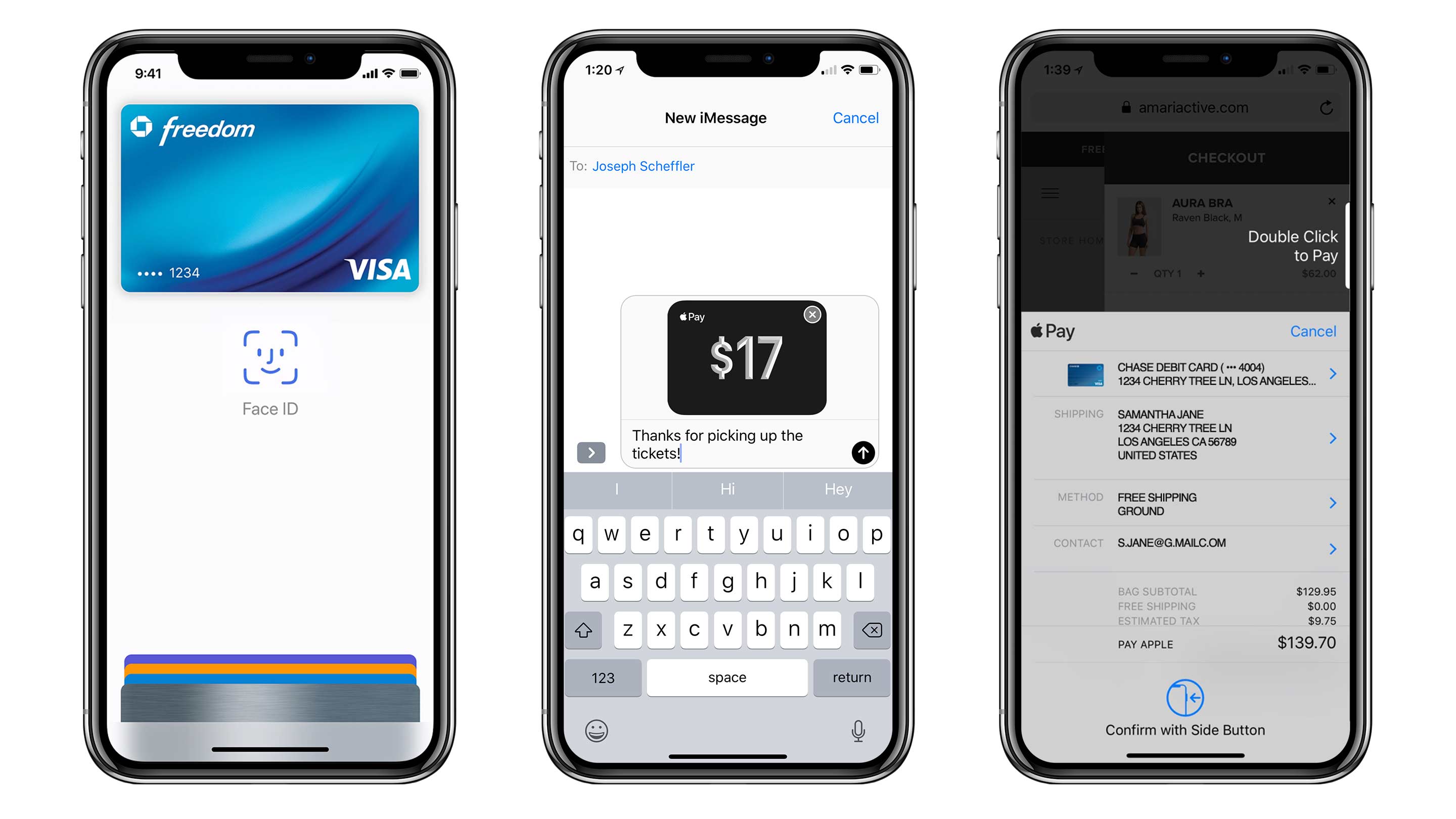

Apple Pay

Apple Pay allows consumers to pay at major retailers, online, or through in-app purchases using just their thumbprint or facial recognition (only on iPhone X) for validation. You can even send and receive money through Apple Pay in Messages.

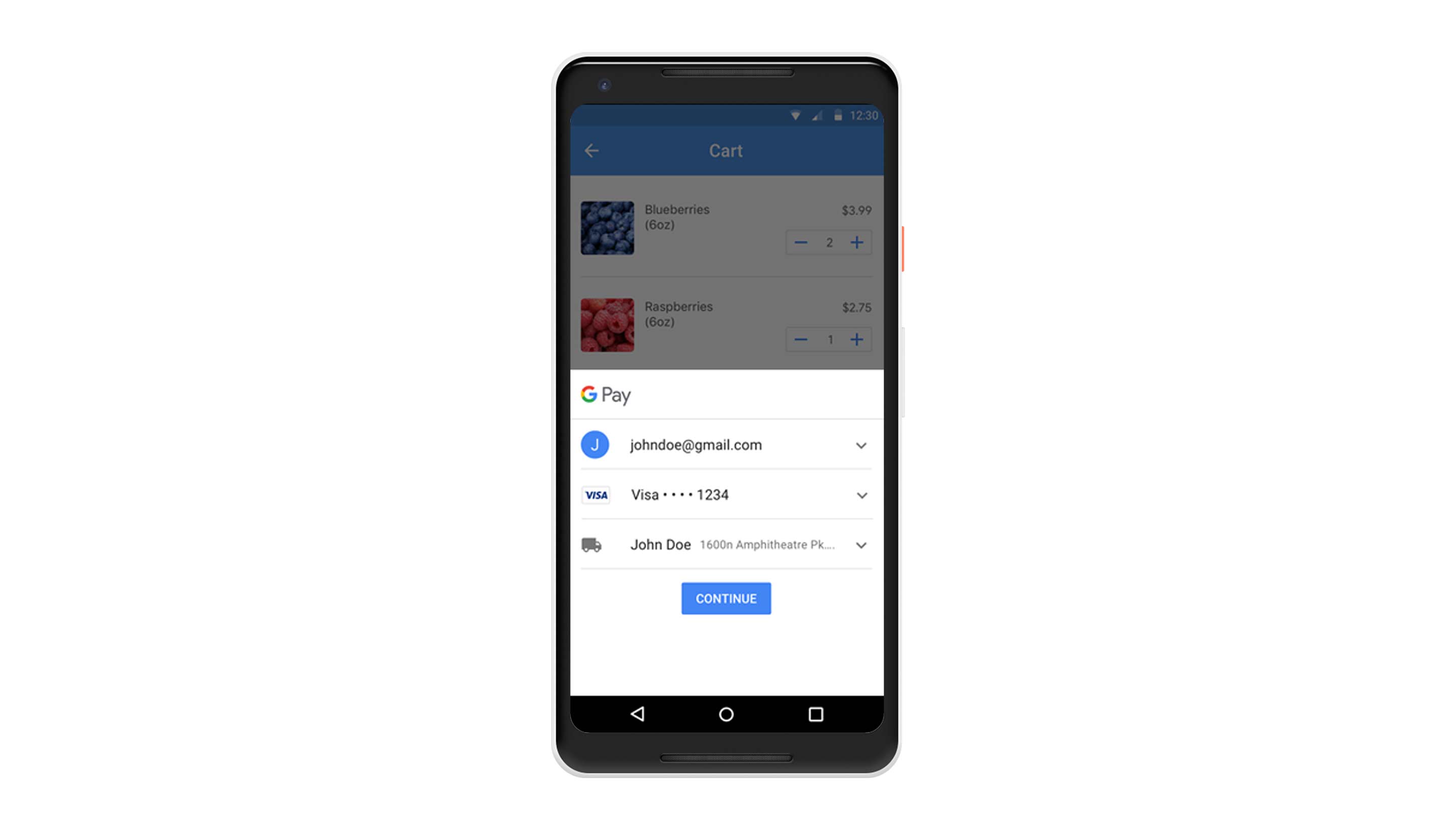

Google Pay

Payment information saved in your Google account will be available everywhere you use Google products: in Chrome for web purchases, in YouTube for renewing your subscriptions, in apps on Android for in-app purchases, and even at certain retailers. This provides for a faster, more secure payment process wherever you go. Google Pay is the combination of its payment options including Google Wallet and Android Pay.

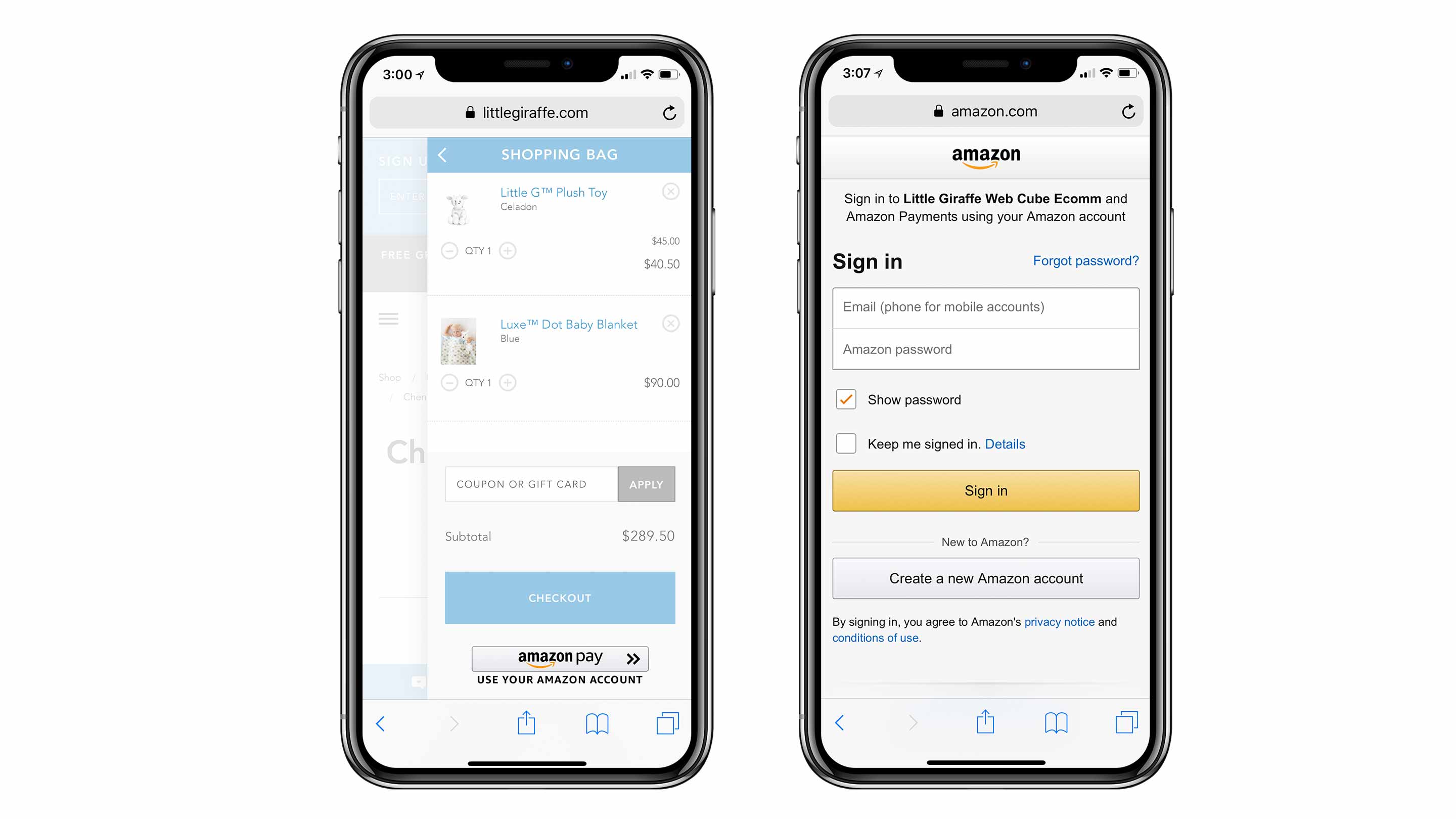

Amazon Pay

Amazon Pay lets you use information stored in your Amazon account to pay and arrange for delivery from tens of thousands of merchants. There are no fees involved and your payment information isn’t shared with the merchant you’re buying from. If you’re an Amazon addict, this one was made for you. Check out how we integrated Amazon Pay for our client, Little Giraffe.

PayPal

Sixty-six billion dollars was spent globally on mobile devices with PayPal in 2015, and the number has surely risen from there. PayPal One Touch allows the user to check out with their stored information in PayPal. You can use this feature on your phone or tablet, including iOS or Android devices.

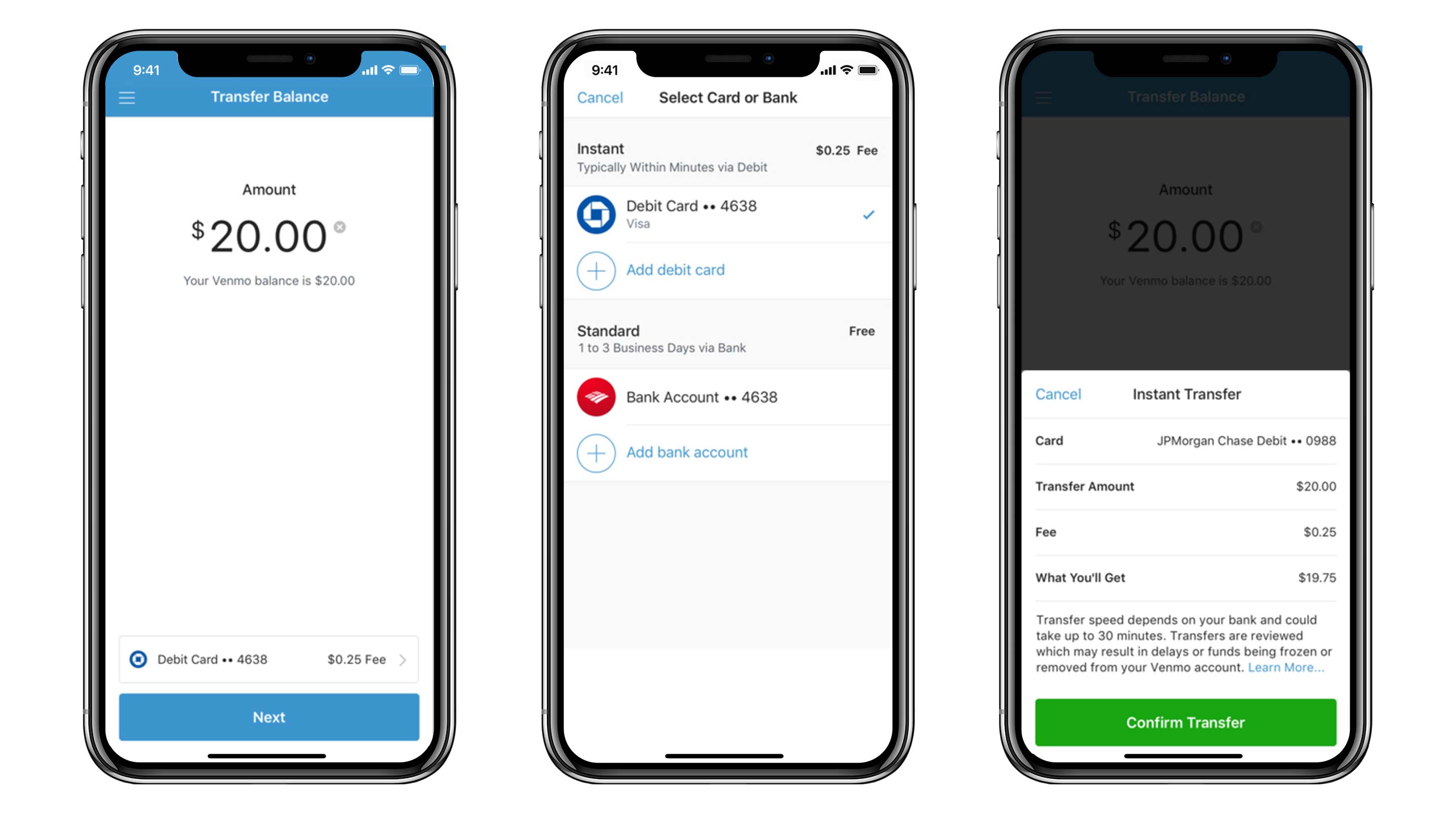

Venmo

Venmo is currently expanding into online retail allowing payment on websites that accept PayPal. Simply tap Paypal on your phone to pay with your Venmo balance. What makes Venmo different from other mobile payment services is its social interaction aspect. Users of Venmo can see what others are purchasing and who they’re paying, and in turn can like and comment on other people’s transactions (not if the user made the transfer or payment private, however).

These technologies enable a faster and more convenient checkout process on mobile devices for customers. The zero-click checkout experience is still in its early stages and as it hits critical mass it will drive a paradigm shift that shopping on a phone will actually be easier than on a computer.

Many industries are still ripe for disruption in this area. If you find your competition is not offering mobile payments or their mobile payment experience is poor, this could be a great strategy for you to improve your online checkout to have a best-in-category experience.

Integrating mobile payments for a zero-click checkout will also improve your mobile conversion rate, capturing customers that may drop off because they are deterred by a lengthy mobile checkout process.

While still in its early stages, it will become an expectation in the future that customers can check out with thumbprint and facial recognition using mobile payments. Say goodbye to digging for your wallet, and hello to the future of faster, more secure checkouts.